Investment Portfolio Simulation

Project Description

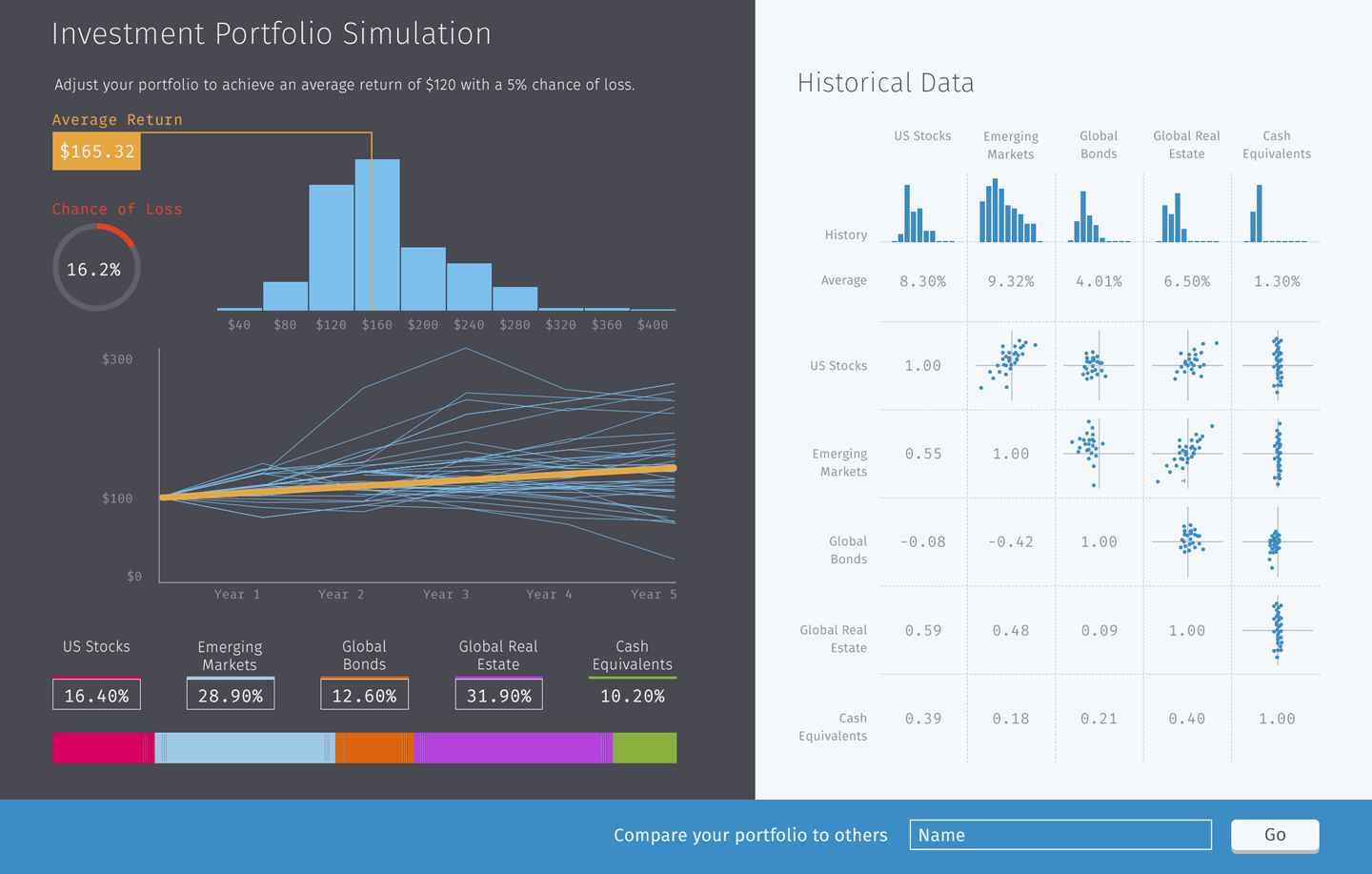

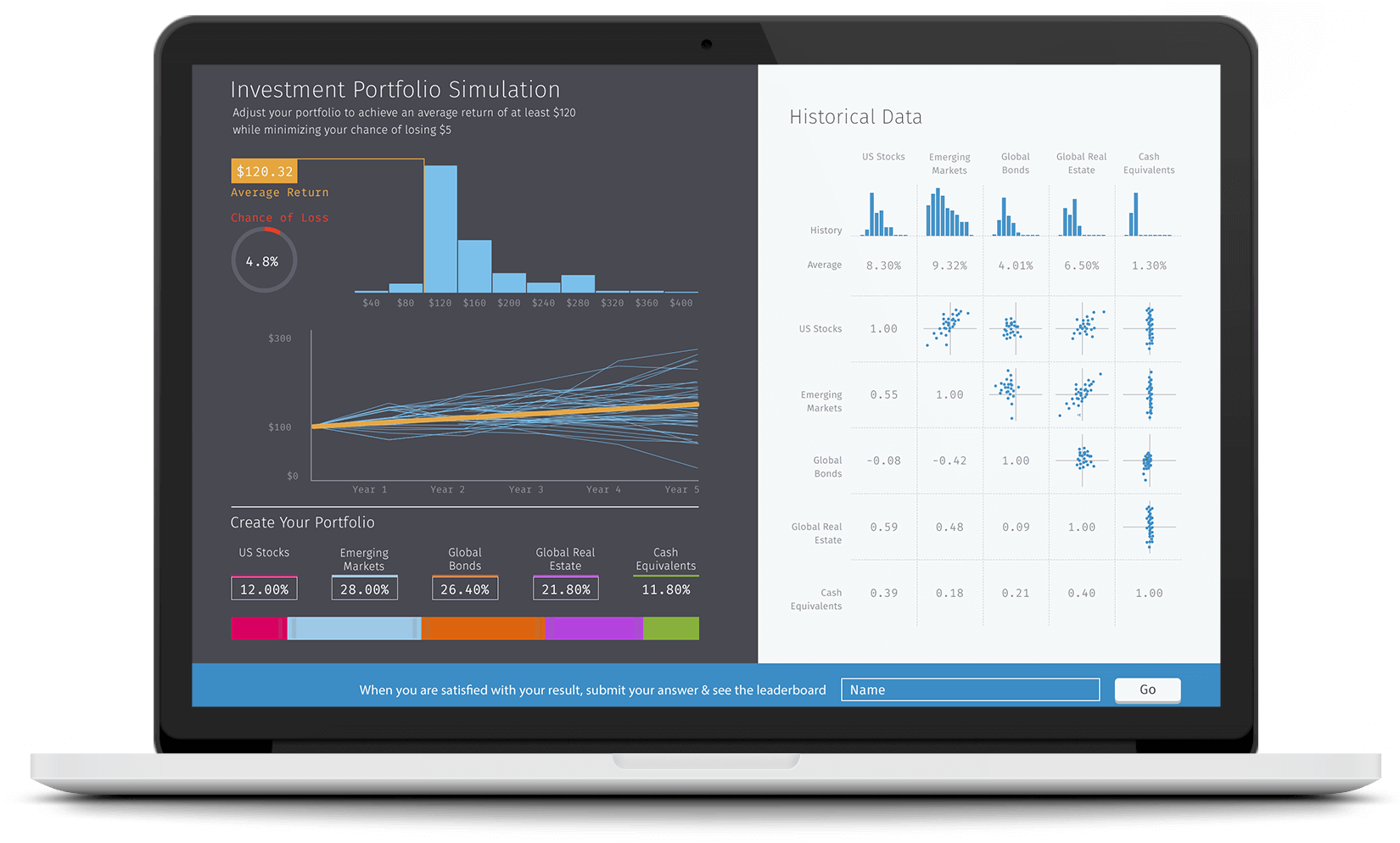

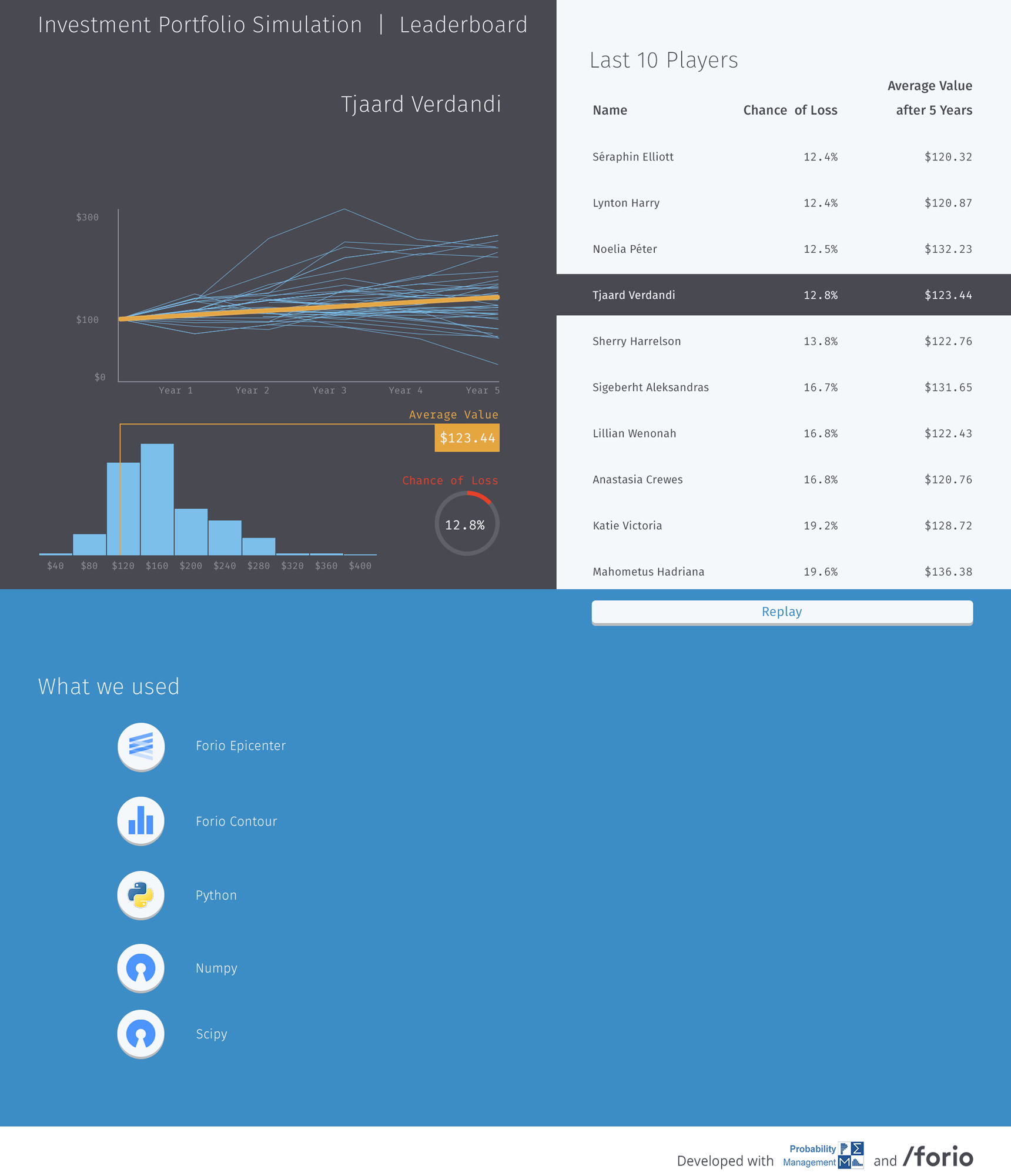

The game is based on examples from his book The Flaw of Averages. The model uses a Monte Carlo method to simulate stock market positions based on historical data. Players adjust a portfolio across US stocks, emerging markets, global bonds, global real estate, and cash equivalents, seeking to achieve an average return of at least $120 while minimizing the chance of losing $5. Anyone can play the simulation, and then see where their results rank on a public leaderboard. The goal is to illustrate the concept of “flawed” averages, that is, the idea that “plans based on average assumptions are wrong on average.”

- Back to All Works

- Case Study: Faces App

- Case Study: Forio Epicenter

- Case Study: PennSTART

- Everest Simulation

- Alternative Fuel Vehicle Simulator

- Alternate Reality Teaching

- Texas Electricity-Water Nexus Simulator

- Investment Portfolio Simulation

- Latino Vote Map

- VenueConnect: Masters Thesis

- Compare-O-Marator